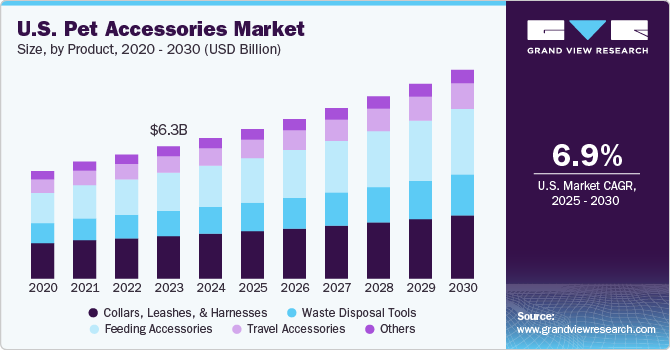

The global pet accessories market size was estimated at USD 6.71 billion in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2030. The global pet accessories industry is anticipated to showcase strong growth in the coming years driven by rising pet adoption trends, increasing demand for pet-related products and services, and pet humanization trends. Pet accessories encompass a diverse range of products such as collars, leashes & harnesses, bedding, feeding accessories, waste disposal tools, etc.

There has been a notable surge in global pet ownership, with an increasing number of individuals welcoming pets into their homes as cherished companions. Pets are regarded as integral family members and receive attentive care and affection from their owners. Recent behavioral patterns indicate that couples often opt to adopt pets as a preliminary step toward gauging their readiness for parenthood. According to the American Pet Products Association, as of 2023, 90.5 million households in the United States were pet owners, marking a 7.0% uptick from the 84.6 million households recorded in 2019. Remarkably, this surpasses the number of households with children, which stood at 52.8 million. This growing pet ownership landscape underscores the potential for sustained demand in the pet accessories market, as owners seek to enhance their pets’ quality of life through a variety of accessory offerings.

Prominent players in the global market are actively introducing a variety of pet accessories products. For instance, in November 2023, True Religion, a renowned lifestyle apparel and accessories brand, unveiled its inaugural collection tailored for pets. True Religion partnered with Wiesner Products Inc. through its pet division, Paw NYC, to license True Religion-branded products for both dogs and cats, slated for release in Spring 2024. The licensed products encompass pet apparel, beds, toys, collars, leashes, harnesses, feeders, and cold-weather accessories. Such strategic product launches serve to broaden product offerings and boost the product demand among consumers.

Pet owners are increasingly emotionally invested in their pets, viewing them as indispensable family members. This sentiment drives a growing inclination among pet owners to spend more on pet care, including accessories, to uphold the well-being and comfort of their pets. Data published by the American Pet Products Association reveals substantial expenditure on pets within the U.S., amounting to USD 136.8 billion in 2022. Projections for 2023 indicate a further increase to USD 143.6 billion, reflecting a 5.0% year-on-year growth. This rising expenditure by pet owners across the globe is anticipated to significantly bolster the expansion of the global market.

The implementation of pet waste disposal laws presents a significant opportunity for the growth of the pet waste disposal tools market. As municipalities enact regulations mandating the proper disposal of pet waste, pet owners are increasingly compelled to seek effective solutions for managing and disposing of their pets’ waste responsibly. The Austin Texas Code of Ordinances Animal Regulations (under section 3-4-6) states that an owner or handler must promptly remove and dispose of any feces left by their dog or cat on public or private property, excluding the owner’s property, and violation of this law can lead to fines upto USD 500. This surge in regulatory compliance drives up the demand for pet waste disposal tools, including waste bags, scoopers, disposal bins, and enzymatic cleaners.

Businesses operating in the pet waste disposal tools sector stand to benefit from this regulatory landscape by offering innovative and convenient solutions that cater to the needs of pet owners seeking to comply with local ordinances. By emphasizing the effectiveness, ease of use, and eco-friendliness of their products, companies can capitalize on the growing demand for pet waste disposal tools driven by regulatory requirements.

Technological innovations are transforming the pet accessories industry, with the emergence of smart and connected devices designed to enhance pet care and monitoring. Examples include GPS trackers, automated feeders, pet cameras, and interactive toys that allow pet owners to remotely engage with their pets. Pet owners seek accessories that reflect their pet personalities and preferences. Customization options, such as personalized collars, engraved tags, and embroidered bedding, enable pet owners to create unique and bespoke accessories tailored to their pets.

Subscription-based models are gaining traction in the pet accessories market, offering convenience and value to pet owners through curated boxes of toys, treats, and accessories delivered regularly to their doorstep. For instance, Woof Box, a subscription box company based in India, specializes in providing dog subscription boxes tailored to meet the needs of pet owners seeking high-quality products for their canine companions. Each monthly box curated by Woof Box includes a selection of premium toys, wholesome gluten-free treats, and stylish accessories designed to enhance the enjoyment and well-being of dogs. Through its commitment to quality and comprehensive pet care, Woof Box aims to establish itself as a trusted provider of premium pet accessories within the Indian market.

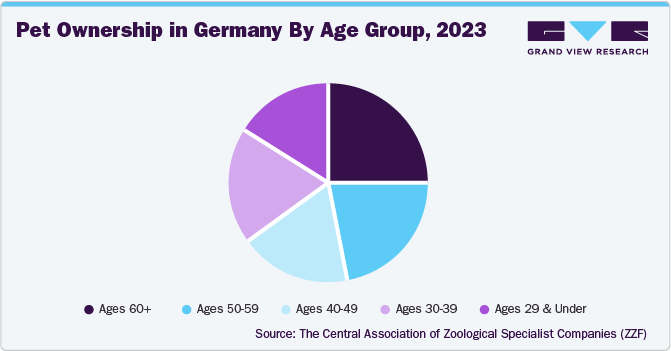

The pet accessories industry demonstrates nuanced consumer engagement across distinct age demographics, each contributing uniquely to market dynamics. Millennials and Generation Z constitute a pivotal segment, distinguished by their preference for premium, design-oriented products that seamlessly integrate functionality with visual appeal. Their purchasing behaviors are heavily influenced by social trends and a growing inclination towards sustainable and technologically advanced offerings.

In parallel, Baby Boomers represent a formidable consumer base, driven by the emotional value placed on pets as companions, resulting in increased demand for wellness-oriented and comfort-driven accessories. Generation X, positioned between these cohorts, exhibits a pragmatic approach, prioritizing durability, versatility, and value-driven products. A comprehensive understanding of these demographic profiles is essential for market participants seeking to align product development, branding, and marketing strategies with evolving consumer expectations.

The above chart offers valuable insights into the demographic structure that influences the demand for pet accessories. The age group distribution highlights that individuals aged 60 and above account for the largest segment, comprising 25% of pet ownership. This demographic’s purchasing behavior is likely characterized by a preference for practical and health-centric pet accessories that cater to the comfort and well-being of aging pets, reflecting their long-term commitment to pet care.

The next significant group includes those aged 50-59 (22%), followed by the 40-49 age bracket (19%). These cohorts often exhibit established financial stability, which positions them as key consumers for premium pet accessories, such as high-quality bedding, smart feeding systems, and wellness-focused products. Notably, younger demographics, including the 30-39 age group (18%) and individuals aged 29 and under (16%), also represent a vital segment. These groups demonstrate a strong inclination toward innovative and aesthetically appealing products, often driven by trends in sustainability and digital technology. Their engagement with social media further amplifies the demand for customizable and design-forward pet accessories.

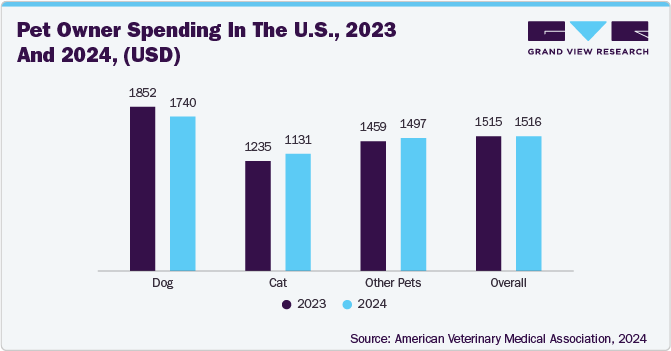

The comparative data on the U.S. pet owner spending for 2023 and 2024 highlights a stable and growing market, with overall expenditure per household remaining steady at approximately $1,515. Notably, spending on dogs consistently outpaces that for other pets, reflecting heightened demand for premium products, including high-quality accessories such as collars, harnesses, and smart feeding systems.

The increase in spending on cats, rising from $1,235 in 2023 to $1,311 in 2024, underscores a growing interest in specialized accessories tailored for feline care, such as enrichment toys and ergonomic furniture. The incremental rise in spending on “other pets” further indicates an expanding niche market for customized accessories catering to exotic and small animals. This spending trajectory underscores the pet accessories market’s evolution, with a shift toward premiumization and innovation-driven purchases. Brands that align their offerings with this trend by focusing on health, sustainability, and technological integration are well-positioned for sustained growth.

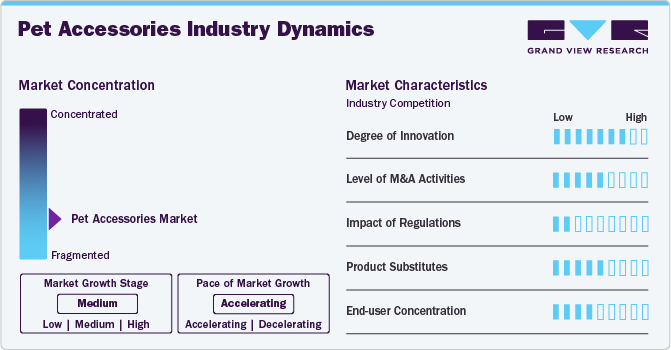

In the pet accessories industry, the degree of innovation plays a pivotal role in driving competitiveness and meeting evolving consumer demands. Companies invest in research and development to introduce novel products with advanced features, materials, and functionalities, catering to the diverse needs of pet owners. Innovations such as smart pet devices, eco-friendly materials, and customized accessories contribute to market differentiation and customer engagement.

Navigating the regulatory landscape is essential for pet accessory manufacturers and retailers. Compliance with regulations governing product safety, labeling, and materials ensures consumer trust and adherence to industry standards. Regulatory changes, particularly in areas such as animal welfare and environmental sustainability, shape product development strategies and market dynamics, influencing companies’ operational practices and market positioning.

Product substitutes represent a notable aspect of competition within the pet accessories industry. While traditional accessories like collars, leashes, and toys remain popular, emerging alternatives such as eco-friendly products, subscription boxes, and tech-driven solutions offer alternatives for discerning pet owners. Companies must monitor market trends and consumer preferences to identify potential substitutes and adapt their product offerings and marketing strategies accordingly to maintain a competitive edge.

Pet collars, leashes, and harnesses accounted for a market share of 31.92% in 2024. Collar leashes are essential tools for ensuring the safety and control of pets during walks or outdoor activities. With an increased emphasis on pet safety and responsible pet ownership, more pet owners are recognizing the importance of using reliable and durable collar leashes to keep their pets secure and under control in public spaces. As outdoor and recreational activities with pets gain popularity, the demand for durable and versatile collar leashes suitable for various environments is on the rise. Pet owners engaged in activities such as hiking, camping, or jogging with their pets seek collar leashes that offer durability, comfort, and ease of use in outdoor settings.

The demand for pet feeding accessories is anticipated to grow at a CAGR of 8.1% from 2025 to 2030. Pet owners are increasingly conscious of their pets’ health and nutrition needs, driving demand for feeding accessories that support healthy eating habits and portion control. Specialized feeding accessories such as slow feeder bowls, elevated feeders, and portion-control feeders are gaining popularity as pet owners seek to optimize their pets’ health and well-being.

The dog accessories held a market share of 46.74% in 2024. A steady rise in pet ownership globally, particularly dogs, fuels the demand for accessories as pet owners seek to provide their canine companions with a higher quality of life, stimulating market growth. With pets increasingly viewed as integral family members, pet owners prioritize the well-being and comfort of their dogs, leading to a surge in demand for accessories that cater to their needs, including travel, feeding, and bedding accessories. Based on data from Forbes Advisor in 2023, pet ownership in the U.S. is prevalent, with approximately 70% of households owning pets. Among these, dogs represent the most popular choice, accounting for 44.5% of households in 2022, followed by cats at 29%.

The demand for cat accessories is projected to grow at a CAGR of 7.7% from 2025 to 2030. The trend towards premium and personalized products extends to the cat accessories market, with pet owners willing to invest in high-quality, customized accessories that reflect their cats’ unique personalities and preferences, driving growth in the premium and niche segments of the market.

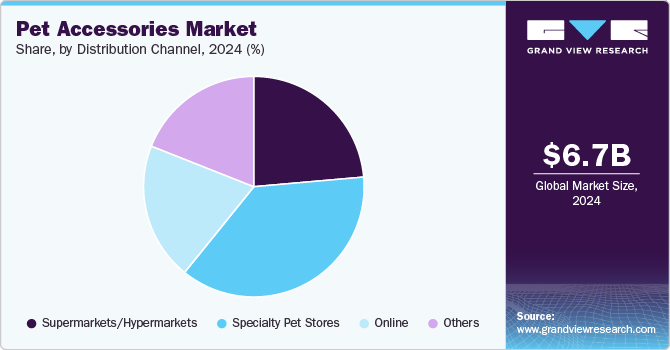

The sales of pet accessories through specialty stores accounted for a market share of 37.21% in 2024. Pet specialty stores employ staff who are knowledgeable about pets and their needs. Customers value the expertise of store employees who can provide personalized recommendations based on the specific requirements of their pets. These types of stores also offer a diverse selection of pet accessories, including unique and specialized items that may not be available in general retail stores. Customers appreciate the wide range of products available, allowing them to find accessories tailored to their pets’ preferences and requirements.

The online sales channel is expected to grow at a CAGR of 8.8% from 2025 to 2030. Online distribution is fueled by the expansion of online offerings by brick-and-mortar pet product specialists around the globe. Retail giants like PetSmart and Petco are leveraging their established presence to provide customers with an extended range of products and services. Online sales channels often feature competitive pricing due to lower overhead costs compared to brick-and-mortar stores. Customers can find affordable options for pet accessories online, with the possibility of comparing prices across different retailers to secure the best deals.

The pet accessories industry in North America held a revenue share of 39.51% in the global revenue in 2024. North America has witnessed a steady rise in pet ownership, with a significant proportion of households welcoming pets into their homes. As pets are increasingly regarded as family members, pet owners are inclined to invest in accessories that enhance the well-being, comfort, and lifestyle of their beloved companions, driving demand for a wide range of pet accessories.

The pet accessories industry in the U.S. is set to experience substantial growth in the coming years, and is expected to grow at a CAGR of 6.3% from 2025 to 2030. As per the American Society for the Prevention of Cruelty to Animals data cited in the Pet Adoption Statistics 2024 article by Forbes Advisor, around 2 million dogs, and 2.1 million cats are adopted annually from pet shelters in the U.S. This influx of adopted pets creates a significant market opportunity for the pet accessories industry, as pet owners seek out essential products and accessories to care for their newly adopted companions, thereby driving growth of the market.

The Asia Pacific pet accessories industry is projected to grow at a CAGR of 8.5% from 2025 to 2030. The pet population in the Asia Pacific has witnessed a significant increase over time, as reported by statistics from Rakuten Insight. More than half of the population in the region owns a pet, with dogs being the preferred choice followed by cats. Notably, Indonesia and Malaysia deviate from this trend, with higher cat ownership rates (47% and 34% respectively) compared to dog ownership rates (10% and 20% respectively). The growing pet population in the Asia Pacific region, particularly the preference for dogs and cats, presents a lucrative market opportunity for the industry.

In the competitive landscape of the pet accessories industry, companies vie for market share by offering diverse product portfolios tailored to meet the evolving needs and preferences of pet owners. Key players deploy strategies such as product innovation, brand differentiation, strategic partnerships, and effective marketing campaigns to gain a competitive edge and capture consumer attention. Additionally, factors such as pricing strategies, distribution channels, customer service, and reputation play crucial roles in shaping the competitive dynamics within the industry.

Some of the key developments and strategic initiatives carried out by leading manufacturers are listed below:

In January 2025, Authentic Brands Group, a global brand development and licensing company, partnered with pet fashion brand K9 Wear to launch a premium collection of pet accessories under the Izod label. The line featured functional dog harnesses, vibrant bandanas, weather-resistant raincoats, durable collars, leashes, and stylish bowls. Designed by Jeffrey Banks, an award-winning American fashion icon, the collection is thoughtfully curated to offer pet owners distinctive and high-quality products, blending style and functionality.

In October 2023, PetPace, a prominent figure in pet health monitoring, announced the release of its latest Health 2.0 smart dog collar, offering continuous health monitoring, early symptom detection, disease management, and location tracking. Utilizing artificial intelligence, PetPace’s innovative technology provided invaluable medical insights to owners of aging, ill, or vulnerable dogs, addressing often overlooked health concerns.

In May 2023, Millie Bobby Brown’s Florence by Mills brand introduced a comprehensive collection of pet apparel and accessories through a long-term agreement with Kanine Group subsidiary, Kanine Pets World Limited.

The following are the leading companies in the pet accessories market. These companies collectively hold the largest market share and dictate industry trends.

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 7.15 billion

|

|

Revenue forecast in 2030

|

USD 9.97 billion

|

|

Growth rate

|

CAGR of 6.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Actuals

|

2018 – 2024

|

|

Forecast period

|

2025 – 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, pet type, distribution channel, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain, China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

|

|

Key companies profiled

|

The Hartz Mountain Corporation; Ancol Pet Products Limited; Kanine Pets World; Wahl Animal; Rosewood Pet Products; PetPace; Spectrum Brands Holdings; Heads Up For Tails; Rolf C. Hagen Inc.; ferplast S.p.A

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options |

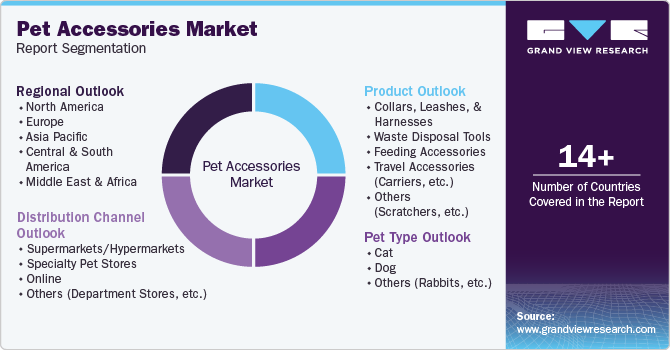

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global pet accessories market report based on product, pet type, distribution channel, and region:

Product Outlook (Revenue, USD Million, 2018 – 2030)

Collars, Leashes, and Harnesses

Waste Disposal Tools

Feeding Accessories

Travel Accessories (Carriers, etc.)

Others (Scratchers, etc.)

Pet Type Outlook (Revenue, USD Million, 2018 – 2030)

Cat

Dog

Others (Rabbits, etc.)

Distribution Channel Outlook (Revenue, USD Million, 2018 – 2030)

Supermarkets/Hypermarkets

Specialty Pet Stores

Online

Others (Department Stores, etc.)

Regional Outlook (Revenue, USD Million, 2018 – 2030)

North America

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

China

Japan

India

Australia & New Zealand

South Korea

Central & South America

Middle East & Africa

b. The global pet accessories market was estimated at USD 6.71 billion in 2024 and is expected to reach USD 7.15 billion in 2025.

b. The global pet accessories market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 9.97 billion by 2030.

b. North America dominated the pet accessories market with a share of around 39.51% in 2024. North America has witnessed a steady rise in pet ownership, with a significant proportion of households welcoming pets into their homes.

b. Some of the key players operating in the pet accessories market include The Hartz Mountain Corporation, Ancol Pet Products Limited, Kanine Pets World, Wahl Animal, Rosewood Pet Products, PetPace, Spectrum Brands Holdings, Heads Up For Tails, Rolf C. Hagen Inc., and ferplast S.p.A.

b. Key factors that are driving the pet accessories market growth include rising pet adoption trends, increasing demand for pet-related products and services, and technological advancements in pet products.

Leave a comment