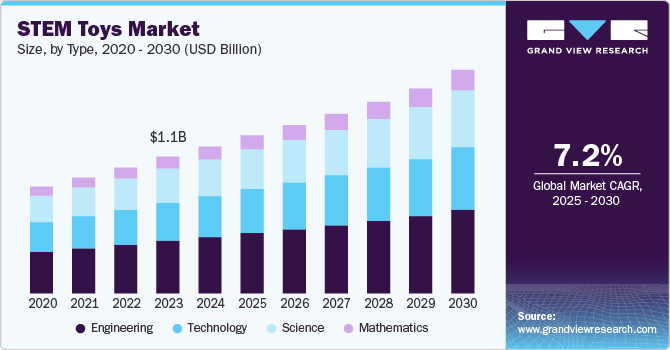

The global STEM toys market was estimated at USD 1.20 billion in 2024 and is expected to grow at a CAGR of 7.2% from 2025 to 2030. The market has evolved significantly, with a noticeable shift towards products that combine learning with play. During the pandemic, families sought engaging ways to support education at home, driving interest in toys designed to promote science, technology, engineering, and math skills. This trend has continued, with toy manufacturers increasingly prioritizing the integration of real-world relevance and creativity into their designs. The emergence of STEAM toys, which add an arts component, highlights the growing emphasis on a holistic approach to child development in the STEM toys industry.

The growing demand for educational experiences that go beyond the classroom is a key driver for the market. Parents actively seek toys that encourage problem-solving, creativity, and critical thinking. The appeal of STEM toys lies in their ability to nurture curiosity and practical skills, making them a preferred choice for many families. In addition, retailers and subscription services are amplifying their focus on the educational toys industry, providing a wide range of innovative products that align with evolving consumer preferences.

The market presents opportunities for both established brands and emerging players. Accreditation programs for STEM toys are helping to build trust with parents by ensuring that products deliver on their educational promises. Subscription services and online platforms are further expanding the reach of the STEM toys industry, allowing smaller brands to connect with a broader audience. As awareness about the importance of STEM education grows, the market is poised for continued innovation and collaboration between educators, toy designers, and retailers.

Despite its growth, the STEM toys industry faces challenges such as inconsistent labeling and the risk of “STEM-washing,” where toys are inaccurately marketed as educational. Addressing these issues through clear definitions and reliable certifications is essential for maintaining consumer trust. The toy industry as a whole can benefit from these efforts by promoting transparency and quality in product offerings. With a focus on engagement, education, and fun, the educational toys industry is well-positioned to shape the future of play and learning.

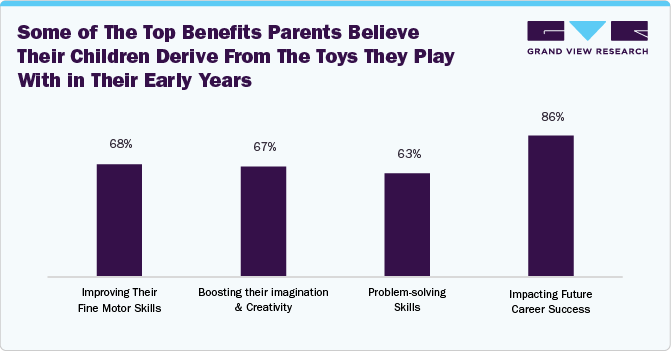

A 2023 survey commissioned by Mattel, conducted with the collaboration of King’s College London, surveyed 1,000 parents with children aged seven and under. The findings revealed that 75% of parents choose toys hoping to influence their child’s future success. Over half (51%) believe toys play a crucial role in developing skills like fine motor abilities (68%) and creativity (67%). Furthermore, 86% think toys can significantly impact future career success.

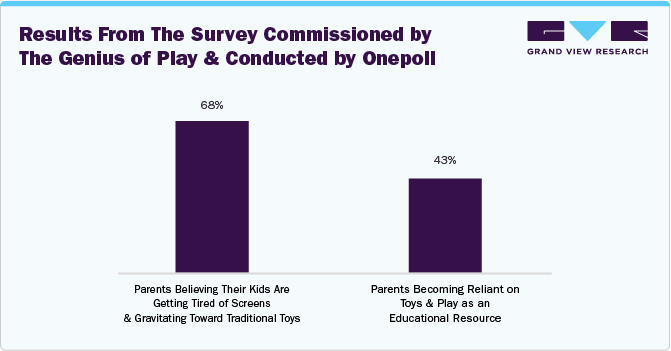

According to a 2020 survey commissioned by The Genius of Play and conducted by OnePoll, many parents became more reliant on toys as educational resources during the pandemic, with the majority noting their kids were shifting from screens to traditional toys.

Engineering toys accounted for about 38% of the overall market in 2024. These popular toys foster problem-solving, creativity, and hands-on learning, helping children develop critical thinking skills. They also inspire interest in STEM-related careers by introducing foundational engineering concepts at an early age. By offering inclusive designs that appeal to all genders, they play a vital role in breaking stereotypes and encouraging diverse participation in STEM fields.

In March 2024, Playtime Engineering launched its latest product, MyTracks, a kid-friendly electronic music production device designed to simplify beat-making for children. The device, which combines a drum machine, synthesizer, microphone for audio sampling, and sequencer, was introduced through a Kickstarter campaign in April, with an expected retail price of USD 349. MyTracks aimed to make music exploration more accessible to kids by featuring chunky control knobs, levers, and a randomized function. The product adhered to rigorous child safety standards, ensuring it was BPA-free and free of choking hazards.

Demand for mathematical STEM toys is expected to grow at a CAGR of 7.9% from 2025 to 2030. Mathematical toys are beneficial because they foster critical skills like problem-solving, logical thinking, and hand-eye coordination engagingly and enjoyably. By solving math-related challenges, children develop better problem-solving abilities and learn to think creatively. These toys also encourage logical thinking by requiring kids to plan steps to solve problems. Furthermore, math educational toys help improve hand-eye coordination, a key skill for various activities. These toys motivate children to explore more complex mathematical concepts by making learning fun, leading to increased math skills and a lifelong love for learning.

Use of STEM toys among the age group 8-12 years accounted for a share of about 41% in the overall market in 2025. Children between these ages are increasingly curious and open to exploring specific interests like science, engineering, and programming, making them more receptive to STEM toys. At this age, they are more capable of handling complex tasks and concepts, such as building robots, coding, and experimenting with science kits. STEM toys encourage them to develop problem-solving, critical thinking, and technical skills, keeping them engaged and excited to learn beyond the classroom. Moreover, the introduction of more advanced toys and the opportunity to join local STEM communities further fuel their passion for STEM.

Demand for STEM toys among the 3-8 year age group is expected to increase at a CAGR of 7.7% from 2025 to 2030. STEM toys for children aged 3 to 8 are crucial for fostering foundational skills like problem-solving, creativity, and early math concepts. Kids are naturally curious and eager to explore at this age, making interactive toys like building sets, coding robots, and science kits perfect for stimulating their interest in STEM. These toys encourage hands-on learning, helping children develop essential skills in a fun and engaging way. By integrating STEM toys into their playtime, kids build a strong base supporting their continued learning and curiosity as they age.

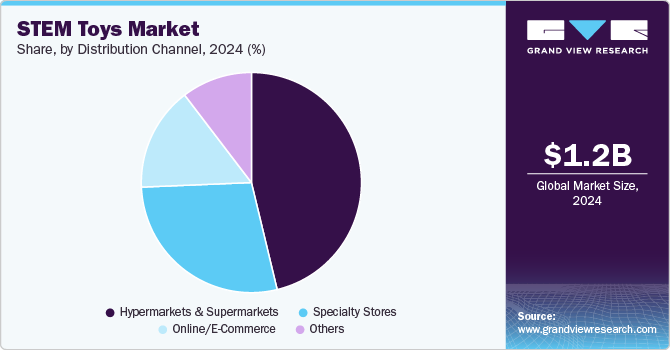

Sales through hypermarkets and supermarkets accounted for a share of about 42% in the STEM toys industry. These channels have seen increased sales of STEM toys due to their convenience and broad product offerings. With toys and STEM-focused items readily available alongside everyday groceries, these stores attract families who may not have planned to buy toys but make impulse purchases during their regular shopping trips. Including popular franchises like Marvel and Star Wars alongside STEAM toys enhances the appeal to children and adult collectors, driving foot traffic. This accessibility and product variety create a seamless shopping experience, boosting sales of STEM toys in these retail environments.

Demand for STEM toys through the online channel is expected to rise at a CAGR of 7.9% from 2025 to 2030. This is due to its convenience, broader product selection, and accessibility. As consumers increasingly prefer the ease of shopping from home, online platforms like Amazon provide a vast range of options catering to diverse customer needs. Brands can leverage targeted advertising and data-driven insights to enhance visibility and engagement. With the ability to reach a global audience and offer personalized shopping experiences, online channels are well-positioned to continue driving growth in the toy industry, particularly as consumer shopping habits evolve.

The STEM toys market in North America accounted for a market share of around 35% in 2024 in the global market. STEM toy demand in North America is rising due to the growing recognition of the importance of hands-on learning for developing skills in science, technology, engineering, and mathematics. Parents and educators increasingly seek engaging and educational toys that promote critical thinking, problem-solving, and creativity. With the expansion of STEM toy offerings, such as those from KiwiCo and solar-powered robots, children can explore various fields of interest, making these toys appeal to a wide age range. In addition, the rise of screen-free activities has contributed to the growing popularity of STEM toys in the region.

The STEM toys market in the U.S. held a dominant 80% share of the North American market. The demand for STEM toys here is growing as parents and educators recognize the importance of teaching kids valuable skills for future success in fields like science, technology, engineering, and mathematics. As the U.S. strives to increase the number of scientists and engineers, parents are seeking toys that entertain and foster creativity, critical thinking, and coding skills. Educational toys like Artie 3000 and Mojobot offer a hands-on approach to learning, making STEM more accessible and engaging for children.

The STEM toys market in Europe accounted for a share of about 24% of the overall market in 2024. In February 2023, ThreeSixty Group showcased its portfolio of brands, including FAO Schwarz, Sharper Image, Discovery Toys, and Discovery #Mindblown, at the Nuremberg Toy Fair as part of its expansion into the European market. The company announced new distribution partnerships in France, the UK, and the Nordics, aiming to bring its innovative products to a wider audience. This expansion reflects the growing demand for STEM toys in Europe, with Discovery #Mindblown’s interactive, educational offerings appealing to children’s curiosity and creativity, further fueling the region’s interest in STEM-based play.

The STEM toys market in Asia Pacific is set to grow at a CAGR of 7.8% from 2025 to 2030. The industry here is poised for growth as brands like Tonieboxes gain traction in markets like Hong Kong despite declining birth rates. Companies target young and aspirational parents with interactive, educational toys promoting early childhood development. The increasing demand for innovative learning tools, effective marketing strategies, and collaborations with educational institutions highlight the region’s expanding interest in STEM-based products. This shift aligns with the growing focus on nurturing future skills in children across the APAC region.

The market is fragmented primarily due to several globally recognized players and regional players. Some prominent companies in this market are LEGO Group, Mattel, Inc., Sphero, Ravensburger, and Hasbro. Market players differentiate through expansions, investments, and launches to cater to evolving consumer preferences.

The following are the leading companies in the STEM toys market. These companies collectively hold the largest market share and dictate industry trends.

In October 2024, Wondery announced the launch of its first-ever line of toys and consumer products inspired by the science podcast for kids, Wow in the World. The Wondery Kids & Wow in the World toy line features STEM kits, dino play, and audio-play figurines, reimagined classic toys with engaging companion audio from the podcast hosts. Available on Amazon and select specialty retailers, the toys combined fun and hands-on learning, providing a unique experience for kids and their grown-ups.

In May 2024, Horizon Group USA launched a new collection of Star Wars-themed STEM activities, featuring products like Star Wars Slime Jars and Lightsaber-Themed Engineering Kits. These kits, aimed at kids aged 6 and up, offered hands-on learning experiences, such as creating lightsabers with LEDs and circuits and growing cyber crystals. The collection was designed to combine sensory play with educational content, enhancing STEM learning for Star Wars fans.

In January 2020, Lego Education launched Spike Prime, a new education system designed to teach engineering and robotics concepts to kids aged 10 and up. This system, aimed at sixth to eighth graders, was unveiled to celebrate the division’s 40th anniversary. Unlike traditional Lego kits, Spike Prime includes a toolbox with various Lego elements and additional hardware, making it a hands-on educational tool for classrooms.

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.29 billion

|

|

Revenue forecast in 2030

|

USD 1.83 billion

|

|

Growth rate (revenue)

|

CAGR of 7.2% from 2025 to 2030

|

|

Actual data

|

2018 – 2024

|

|

Forecast period

|

2025 – 2030

|

|

Quantitative units

|

Revenue in USD million/billion, CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, age group, distribution channel, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Japan; South Korea; Australia & New Zealand; South Africa; UAE; Brazil; Argentina

|

|

Key companies profiled

|

LEGO Group; Mattel, Inc.; Sphero; VTech; Melissa & Doug; Hasbro; Thames & Kosmos; Osmo; Ravensburger; Spin Master

|

|

Customization

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

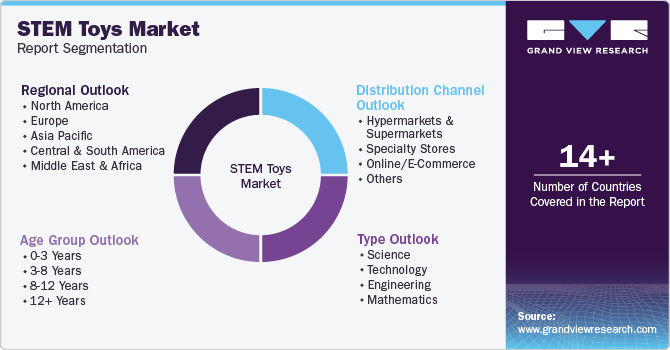

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global STEM toys market report based on type, age group, distribution channel, and region:

Type Outlook (Revenue, USD Million, 2018 – 2030)

Science

Technology

Engineering

Mathematics

Age Group Outlook (Revenue, USD Million, 2018 – 2030)

0-3 Years

3-8 Years

8-12 Years

12+ Years

Distribution Channel Outlook (Revenue, USD Million, 2018 – 2030)

Regional Outlook (Revenue, USD Million, 2018 – 2030)

North America

Europe

UK

Germany

France

Italy

Spain

Asia Pacific

China

India

Japan

South Korea

Australia & New Zealand

Central & South America

Middle East & Africa

b. The global STEM toys market was estimated at USD 1.20 billion in 2024 and is expected to reach USD 1.29 billion in 2025.

b. The global STEM toys market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 1.83 billion by 2030.

b. North America dominated the STEM toys market in 2024 with a share of about 35%. The industry here is booming due to increasing parental emphasis on early skill development and preparing children for future innovation-driven careers.

b. Key players in the STEM toys market are LEGO Group; Mattel, Inc.; Sphero; VTech; Melissa & Doug; Hasbro; Thames & Kosmos; Osmo; Ravensburger; Spin Master.

b. Key factors that are driving the STEM toys market growth include rising parental awareness of skill-building, the integration of technology in education, a focus on hands-on learning, and support for innovative problem-solving skills.

Leave a comment