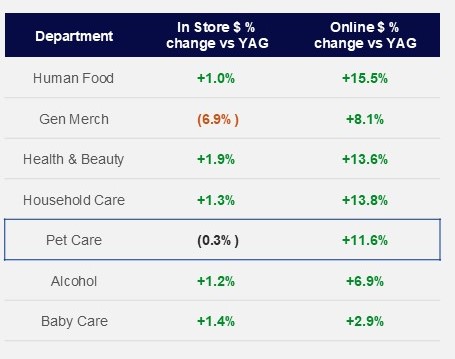

Today, the total Pet Care market is worth more than $83B.1 But, the pet industry is experiencing significant shifts, with growth now being driven exclusively by online sales as brick-and-mortar trends have flattened. While in-store sales have softened across categories like Specialty Animal Food and Pet Accessories, online channels are seeing robust momentum. This shift is largely a result of consumers recoiling from years of inflation, pivoting towards the convenience and cost-efficiency of e-commerce. For the first time since COVID, all departments across the Total FMCG landscape are growing share online, with Pet Care making strong gains as more pet parents turn to digital platforms for their shopping needs.

As unit declines in the pet industry begin to flatten, online sales have emerged as a critical growth driver. Pet parents continue to spend significantly on their pets, with the average annual spend exceeding $1,000 for both dog and cat owners.2 A noteworthy 79% of pet care dollars are now coming from true omnichannel shoppers—those who engage with both online and in-store channels.3 Pet food, in particular, has seen a substantial shift toward online shopping, reflecting consumer preferences for subscription services and the convenience of doorstep deliveries. While online traffic is increasing, the gap between new online purchases and subscription-based buying is narrowing, indicating that pet owners are leaning into regular, automated purchasing for essential pet care items.

Although the omnichannel marketplace is thriving, in-store performance continues to lag behind, with most key categories seeing worse unit trends in brick-and-mortar locations compared to online. This underscores the growing importance for pet brands to optimize their online presence and meet the evolving expectations of today’s pet parents, who are seeking both convenience and value in an increasingly competitive retail landscape.

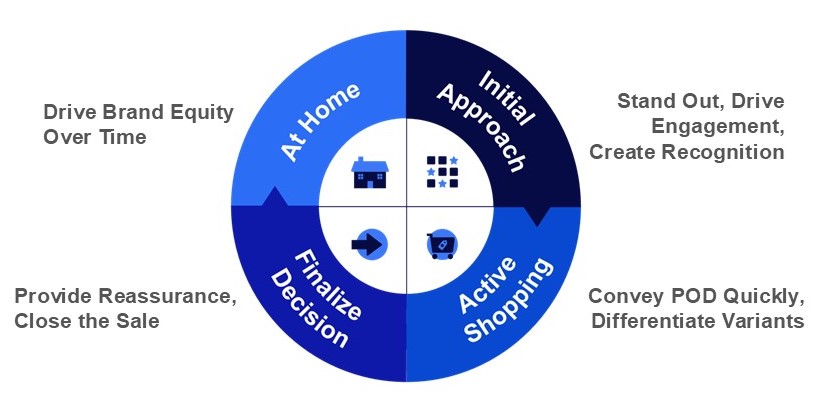

In the omnichannel marketplace, packaging has become the #1 connection between your brand and the pet parent, playing a crucial role in both online and in-store interactions. Whether a customer is browsing the aisles of a store or scrolling through an online retailer, your packaging is often the first and most powerful touchpoint influencing their decision. As online sales continue to grow, the power of the individual pack is amplified, requiring brands to craft packaging that stands out and communicates effectively in any environment.3

An omni pack must fulfill its role regardless of where the interaction takes place. This means ensuring your packaging not only looks good on a shelf but also translates well online, where customers may only have a few seconds to evaluate it. Key factors like color choice, simplicity, and brand cues become critical. For instance, assessing the role that color plays in your pack is essential for creating a visually differentiated product. Additionally, higher-order elements—such as logos, fonts, and product imagery—must support a differentiated pack story that speaks clearly and simply to the consumer.

To maximize the impact of your packaging in an omnichannel setting, brands should consider pack size, the role of the pet in the story, and investment in brand cues. A checklist can help ensure your pack is optimized for omni success:

By following these guidelines, brands can ensure their packaging performs effectively in both physical and digital spaces, creating a seamless connection with pet parents wherever they choose to shop.

As we move into the final quarter of 2024, the pet industry is experiencing a mix of challenges and opportunities, with inflationary pressures easing across most departments. While price increases have begun to level off, the combination of unit and equivalent volume (EQ) declines is causing overall dollar trends in the pet market to soften. Despite this, one key area showing resilience is Pet Food, which has seen positive signs of growth in both units and EQ volume throughout the year.

Within the Pet Food segment, premium diets are emerging as a significant driver of unit growth. Consumers are increasingly willing to invest in high-quality, specialized diets for their pets, contributing to the upward trend in premium pet food purchases. While pet food sales hold steady, other pet supply categories are facing declines across the total market, with the exception of Litter, which continues to perform well. This suggests that while pet parents remain committed to providing their pets with the best nutrition, discretionary spending on non-essential supplies may be tightening.

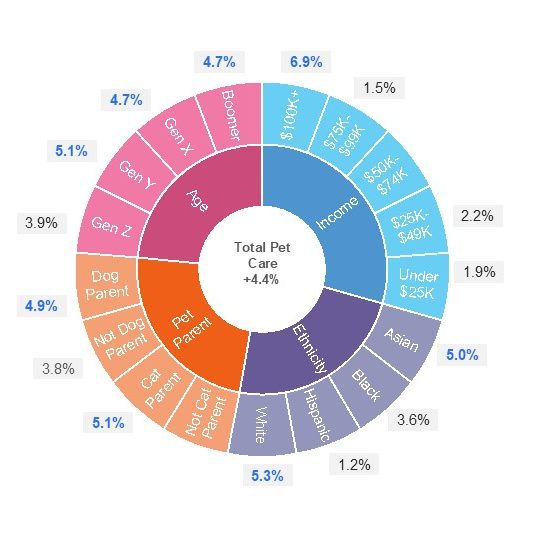

Another noteworthy trend is the rise in sales for both Name and Store brands during price reduction periods. As inflationary pressures ease, consumers are gravitating toward deals and discounts, resulting in an influx of sales when products are offered at a lower price point. Demographically, Pet Care is seeing increased dollar buy rates across the board. In fact, all generations saw an increase in expenditure with all outpacing total Pet other than Gen Z, right behind at +3.9%.4 This signals that despite some softness in the market, pet parents are still committed to investing in their pets’ well-being, particularly regarding essential care products like food and litter.

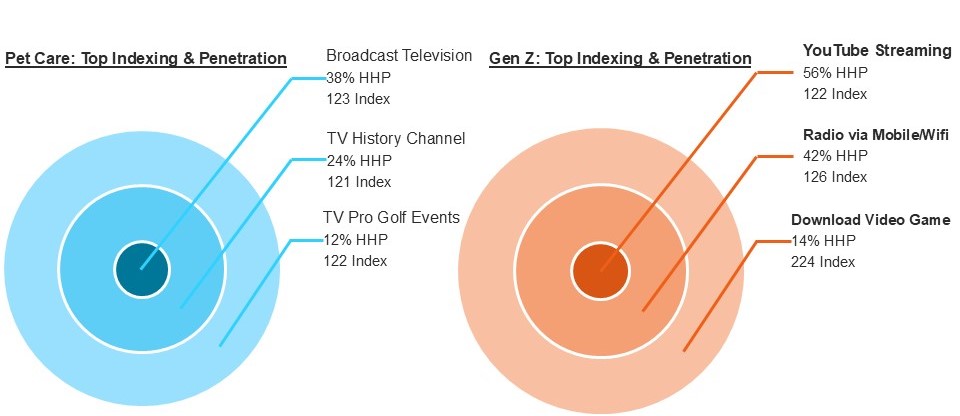

As the next wave of pet parents, Gen Z hasn’t yet reached their full spending potential but shows a promising compound annual growth rate (CAGR) as they continue to establish themselves in the pet market. Like Millennials before them, Gen Z is poised to shift towards Omni-dominant shopping for their pet care needs, making it crucial for brands to adapt and focus on innovative ways to engage this tech-savvy generation. Reaching younger pet parents with fresh marketing approaches and digital-first strategies will help grow brand awareness and loyalty as they evolve into more significant spenders in the years to come.

Interestingly, Gen Z is also bucking some traditional industry trends. They are driving double-digit growth in previously declining categories such as Bird and Fish, while showing a distinct preference for wet-based dog and cat diets. This generation’s unique interests present opportunities for brands to expand into segments that have seen lower engagement in recent years. Gen Z’s focus on these niche categories, coupled with their growing purchasing power, represents an untapped avenue for retailers and brands looking to diversify their offerings.

Gen Z also offers the potential for a total store strategy, as their preferences extend beyond common categories like dogs and cats. They are the focal point of growth in the Bird, Fish, and Reptile segments, presenting an opportunity for pet retailers to revitalize areas of the store that have previously seen declines. By catering to Gen Z’s varied interests, brands can capture this generation’s attention early and foster long-term loyalty across a wider range of pet care categories.

As the pet industry continues to evolve, there are several critical factors that will shape the future for brands and retailers alike. With changing consumer habits, the rise of omnichannel shopping, and emerging demographic trends, it’s essential to stay ahead of the curve.

With that in mind, here are 4 key takeaways for Pet brands to keep in mind going forward:

1. Omnichannel Shopping is on the Rise. The marketplace is increasingly shifting toward an omnichannel model, as consumers move more of their business online. A key driver of this shift is the growing unitary volume of pet products purchased online, while in-store sales are declining. To stay competitive, brands must focus on creating seamless online shopping experiences that cater to the evolving behavior of today’s pet parents.

2. Omni Packaging is Crucial for Success. In an omnichannel environment, packaging plays a critical role in connecting with the omni shopper. Designing packaging that performs well both in-store and online is essential, and simplicity is often the most effective approach. Brands should consider the key functions that a pack must fulfill across channels, ensuring that it communicates clearly and efficiently no matter where it’s encountered.

3. Premium Pet Food is Bucking Market Trends. While inflationary pressures are easing, declines in unit and equivalent volume consumption are starting to drive overall dollar sales down. However, the premium pet food segment continues to show strength, with double-digit unit growth in 2024. This highlights the ongoing demand for high-quality pet food products, even as other categories face slowdowns.

4. Gen Z is a Key Growth Opportunity. Gen Z represents a significant opportunity for manufacturers and retailers. This generation’s preference for online shopping and their influence in niche pet categories like bird, fish, and reptile care make them a critical demographic to target. Brands can best capitalize on Gen Z’s growth wave by developing a total store strategy and leveraging digital platforms to engage these younger pet parents.

1 – NIQ Omnisales; Pet Care Total Omni, L52W w/e 06/29/24

2 – NIQ Discover Omnishopper Total Pet Care, L52W W/E 06/15/24 vs YAG

3 – NIQ Omnishopper Panel, Total Pet Care, L52W W/E 06/15/24 vs. YAG

4 – Source: NIQ Omnishopper Panel, Total Pet Care, L52W W/E 06/15/24 vs YAG

Leave a comment