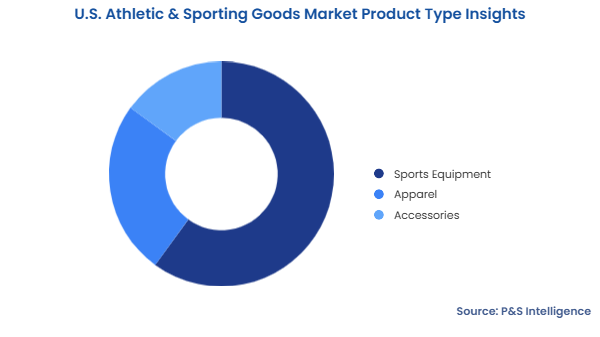

Segmentation and Category Analysis

Insights by Product Type

The sports equipment category dominated the market in 2024 with a share of 60% due to the growing consumer interest in a variety of fitness activities. As Americans prioritize wellness more than ever, they are buying workout equipment for their home, such as treadmills, weights, and resistance bands. Similarly, the growing participation in sports drives an increase in the sale of protective equipment, such as helmets and pads, especially in contact-based activities, such as American football, boxing, and ice hockey.

Apparel is the fastest-growing category because strenuous sports often lead to the tearing of clothes. Hence, the repetitive nature of sports apparel purchase is a key factor behind their rising sale. Moreover, people who take up sports at an early age need more-frequent apparel replacement, as they keep growing out of the clothes they currently have. Further, athletic clothing and shoes are often designed for specific activities, such as sprinting, jumping, swimming, football, tennis, and badminton.

The product types analyzed here are:

- Sports Equipment (Largest Category)

- Balls

- Rackets and bats

- Golf equipment

- Fitness equipment

- Protective gear

- Others

- Apparel (Fastest-Growing Category)

- Activewear

- Outerwear

- Footwear

- Others

- Accessories

- Sports bags

- Water bottles

- Sports technology devices

- Others

Insights by End User

Recreational users constitute the largest end user because Americans are highly focused on health and fitness. The diverse consumer base includes casual gym goers and outdoor activity enthusiasts, who escalate the demand for athletic products, including physical exercise devices, sportswear, and external equipment. The interest in individual sports and activities, including running, cycling, and yoga, continues to rise because of the expanding fitness culture, aided by fitness apps and wearable technology.

Fitness centers and gyms are the fastest-growing category, with an expected CAGE of 7.3% during the forecast period. This is because gym members have been swelling after the pandemic, along with the rapid expansion of boutique fitness studios. The need for high-performance exercise and weight equipment at such facilities essentially drives the market in this category.

The end user analyzed here are:

- Professional Athletes and Sports Teams

- Recreational Users (Largest Category)

- Schools and Educational Institutions

- Fitness Centers and Gyms (Fastest-Growing Category)

- Military and Government Organizations

- Others

Insights by Distribution Channel

The offline channel is the leading category, in 2024. Sporting goods outlets witness a strong sales performance due to their customer-friendly services, which let people see and actively test the products before buying. Offline stores continue to fulfill two essential functions: enabling consumers to buy things urgently and catering to those who prefer physically examining the products. Brands that blend online operations with offline features through delivery points and mobile shopping improvements have been report sharp growth in sales and customer loyalty.

The online category has the higher CAGR because consumers now love the ease of shopping online. Customers choose online shopping because it provides a vast selection of products, affordable prices, and helpful product evaluations. Major e-commerce giants, including Amazon; and the consumer-facing websites operated by brands such as Nike and Under Armour, are flourishing through virtual try-on features, tailored suggestions, and return guarantee programs. The COVID-19 pandemic forced consumers toward online shopping for fitness equipment and sportswear, a trend that will only grow because of the convenience e-commerce offers.

The distribution channels analyzed here are:

- Online (Faster-Growing Category)

- Offline (Larger Category)

Drive strategic growth with comprehensive market analysis

Leave a comment