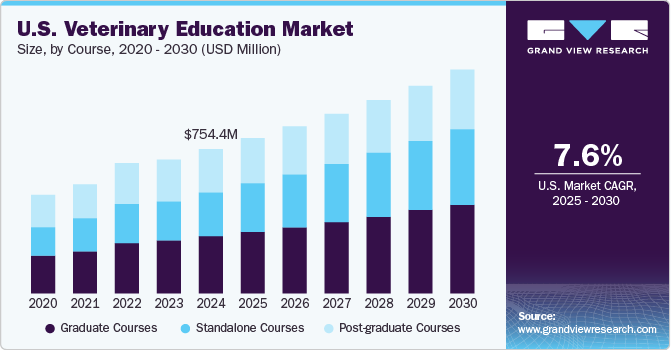

The U.S. veterinary education market size was estimated at USD 754.4 million in 2024 and is anticipated to grow at a CAGR of 7.62% from 2025 to 2030. The market is propelled by the rising demand for specialized services, alongside increasing government initiatives to strengthen veterinary education. Additionally, the integration of technology in education and advancements in animal medicine fuel the need for a highly skilled workforce, contributing to market growth during the forecast period. Emerging fields such as regenerative medicine, diagnostics, oncology, and minimally invasive surgery are also driving curriculum enhancements and the development of more specialized training programs.

Competency-based education has emerged as the preferred model in healthcare education, including veterinary medicine, due to its strong emphasis on outcomes and practical skill development, according to AAVMC. This learner-centered approach ensures that graduates are knowledgeable and capable of performing in real-world clinical settings, directly addressing the growing need for practice-ready veterinarians. For learners, it provides clearer expectations and personalized learning paths; for educators, it offers structured frameworks for assessment and curriculum design. The veterinary profession benefits from a more consistent and reliable workforce, while society gains from improved animal healthcare services. Thus, Competency-Based Veterinary Education (CBVE) plays a pivotal role in shaping the market.

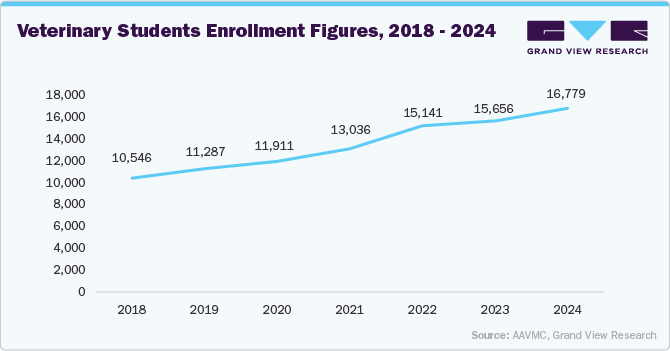

Furthermore, the growing demand for specialized services drives the veterinary education market. According to an article published by the American Veterinary Medical Association (AVMA), in June 2024, around 4,000 veterinarians graduated annually from the United States and international colleges of animal medicine and entered the U.S. workforce; 59.8% of these entered companion animal practice. This implied that about 2,400 new companion animal veterinarians would be added to the labor force annually through 2030. As more graduates enter the field, there’s an accompanying need for internships, residencies, and continuing education programs, creating a secondary demand for educational services and infrastructure, driving growth in the veterinary education sector.

Similarly, organizations such as the American Association of Veterinary Medical Colleges (AAVMC) are strategically partnering with academic institutions, medical associations, industry leaders, and key stakeholders to ensure that colleges and higher education institutions are well-positioned to address the growing workforce shortages and meet the escalating demands of the animal healthcare sector. The persistent shortage of veterinarians is a major catalyst for the market, driving increased demand for academic and clinical training programs, accelerating the expansion of veterinary curricula, and prompting institutions to scale infrastructure and capacity.

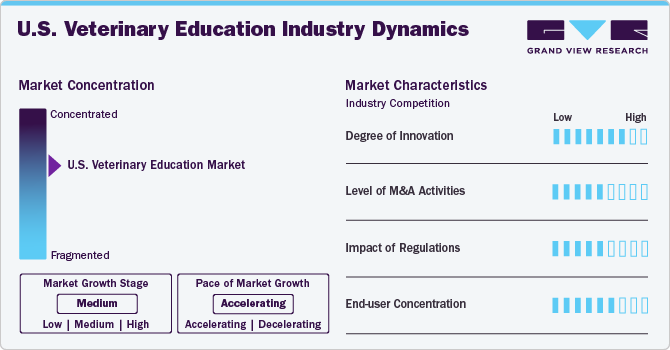

The market exhibits a moderate concentration level and is experiencing accelerated expansion. Currently positioned in a mid-growth phase, the market is witnessing steady development driven by rising demand and evolving industry dynamics.

The market demonstrates a moderate to high degree of innovation, driven by technology integration, curriculum reform, and a shift toward skills-based, specialized training. These advancements are essential in meeting the evolving demands of animal healthcare, addressing workforce shortages, and positioning the market for sustained growth and transformation. Moreover, the market is witnessing strong integration of virtual simulations, augmented reality (AR), artificial intelligence (AI), and online learning platforms to supplement traditional hands-on training. These tools improve access, flexibility, and student engagement while simulating clinical scenarios in a risk-free environment.

The market exhibits a moderate to high level of merger and acquisition (M&A) activity within the veterinary education sector. Educational institutions and private companies actively collaborate, pooling resources through strategic partnerships and acquisitions to enhance their program offerings, expand training capabilities, and reach a wider audience.

Regulations significantly influence the U.S. veterinary education industry by setting accreditation standards, licensing requirements, and curriculum guidelines. Bodies like the AVMA Council on Education ensure quality and consistency across institutions, while federal and state licensing exams shape program structures. Government policies also impact funding, financial aid, and student loan programs, affecting affordability and enrollment.

End user concentration, primarily driven by veterinary students, academic institutions, and animal healthcare providers, significantly influences market dynamics. A high concentration among a limited number of veterinary schools and student applicants can intensify competition for admission, drive up tuition, and limit access to education.

The graduate courses segment accounted for the largest market share of 39.5% in revenue in 2024, due to increasing demand for advanced, specialized training. Graduate programs, including Master’s and Doctoral degrees, offer veterinary professionals opportunities to specialize in fields like veterinary oncology, regenerative medicine, and public health, which are in high demand as veterinary care becomes more sophisticated. For example, institutions such as the University of California, Davis, and Cornell University College of Veterinary Medicine offer graduate programs catering to these advanced study areas. These institutions are expanding their specialty and residency programs to meet the growing demand for highly skilled professionals in emerging fields like veterinary telemedicine, equine surgery, and pediatric care.

The standalone courses segment is anticipated to grow at the fastest CAGR over the forecast period. These courses offer flexible, targeted educational opportunities for professionals seeking to enhance their skills without committing to a full degree program. These courses cater to the evolving needs of the veterinary workforce, focusing on specific skills or emerging areas in animal healthcare, such as veterinary dentistry, pain management, anesthesia techniques, and telemedicine.

Veterinary medicine accounted for the largest market share of 32.5% in revenue in 2024 and is expected to expand at a lucrative CAGR over the forecast period. The increasing prevalence of disorders in companion animals, particularly osteoarthritis (OA), is driving growth in the veterinary medicine segment. Zoetis U.S. reports that more than 40% of dogs suffer from OA. With significant advancements in animal medicine, modern diagnostic and treatment methods for chronic illnesses are now more accessible. Moreover, the University of Pennsylvania School of Veterinary Medicine offers a comprehensive medicine program. The program covers fundamental areas such as small animal medicine, surgery, public health, and animal care.

The animal grooming segment is anticipated to grow at the fastest CAGR over the forecast period. Courses in animal grooming are responding to the expanding pet care industry by focusing on the aesthetics and well-being of pets. These programs offer career opportunities in grooming salons and pet care services, helping to broaden the market. Vocational schools and community colleges have introduced additional certificate and diploma programs in pet grooming and styling to address the growing demand for these services. Additionally, online courses in basic pet grooming have become increasingly popular, providing flexible training options for aspiring groomers.

The public institutions segment dominated the veterinary education market in 2024 and is also anticipated to grow at the fastest CAGR over the forecast period. These institutions offer affordable, high-quality education and training programs that address the growing need for veterinary professionals. Public universities often provide a large portion of the veterinary workforce, and their role in training veterinarians is critical due to their ability to serve a broader, more diverse student base while benefiting from state funding, which makes education more accessible.

Moreover, public institutions frequently collaborate with government agencies and nonprofit organizations, helping to address veterinary shortages and public health needs. For instance, the University of Georgia College of Veterinary Medicine works with the U.S. Department of Agriculture and state-level agencies to train veterinarians who can work in rural areas, providing essential services to underserved populations. In addition to academic offerings, public institutions are crucial in shaping workforce development and aligning educational curricula with government policies, such as addressing the shortage of veterinarians in specific fields or meeting public health standards. This positions public institutions as a primary force driving the overall U.S. veterinary education industry.

E-learning dominated the veterinary education market in 2024 and is also anticipated to grow at the fastest CAGR over the forecast period. The segment offers flexible, accessible, and cost-effective educational opportunities. This segment caters to both veterinary students and professionals seeking continuing education by providing a wide range of online courses, certifications, and degree programs that can be accessed remotely, making it easier for individuals to further their education without the constraints of traditional classroom settings.

Specialized e-learning platforms offer on-demand Continuing Education (CE) courses and webinars for veterinary professionals. For example, in March 2023, the Royal College of Veterinary Surgeons (RCVS) launched an upgraded e-learning platform, Learn, designed to provide free, flexible courses to interested individuals. This platform offers over 30 hours of Continuous Professional Development (CPD) courses on topics such as Evidence-based Veterinary Medicine (EBVM), Quality Improvement (QI), and medication safety. Developed by animal health professionals, it enhances the user experience. It is regularly updated to meet professional standards. The platform aims to support educators in delivering high-quality care through easily accessible learning resources.

More than 2 years segment dominated the veterinary education market with a revenue share of 46.7% in 2024. Extended courses in veterinary education provide comprehensive training that includes both practical internships and research opportunities, playing a crucial role in developing highly skilled professionals. These programs are particularly important in specialized fields such as veterinary surgery, pathology, and emergency medicine, where hands-on experience and advanced knowledge are essential. Beyond the traditional 4-year Doctor of Veterinary Medicine (DVM) programs, there has been a growing trend towards accelerated 3-year degree programs that fast-track students into the workforce, meeting the increasing demand for qualified veterinarians.

The less than one-year segment is anticipated to grow at the fastest CAGR over the forecast period. This segment plays a pivotal role by offering short-term, specialized training programs that cater to the growing need for skilled veterinary support staff and focused expertise in specific areas of veterinary care. These programs are designed for individuals looking to quickly enter the workforce or gain specialized skills without committing to lengthy degree programs.

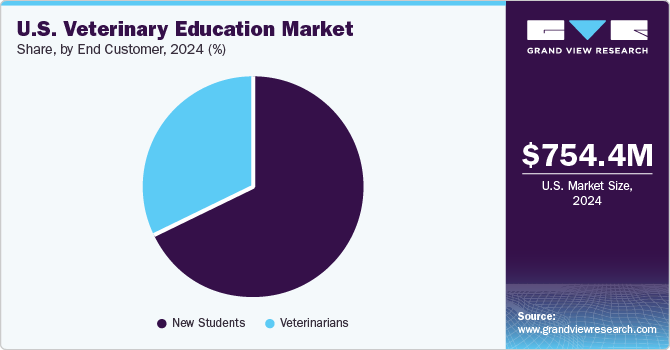

The new students segment accounted for the largest market revenue share of 67.6% in 2024 and is also anticipated to grow at the fastest CAGR over the forecast period. This segment includes undergraduate students applying for Doctor of Veterinary Medicine (DVM) programs and those pursuing specialized certifications, degrees, and associate programs. The increasing interest from new students directly correlates with rising demand for veterinary services, growing pet ownership, and the need for skilled professionals in animal healthcare. The entry of new students increases overall student enrollment in veterinary programs and drives institutional growth, curriculum development, and the expansion of research opportunities, all fueling the broader market.

The veterinarians segment is expected to grow steadily over the forecast period. Practicing veterinarians continually seek to enhance their knowledge and skills, driving strong demand for continuing education programs. This need fosters the development of new courses, workshops, and online learning platforms. As veterinarians specialize in oncology, dentistry, and exotic animal medicine, veterinary schools are responding by expanding their curricula to include more specialized training programs. Additionally, veterinarians who establish their practices or innovative businesses contribute to the evolution of educational offerings, particularly in practice management and business skills.

The tuition segment dominated the market in 2024, directly impacting the affordability and accessibility of veterinary education. The costs associated with veterinary programs, including tuition fees, influence the demand for various types of education, from traditional 4-year Doctor of Veterinary Medicine (DVM) programs to shorter certificate courses. The rise in tuition fees, in particular, drives the growth of alternative learning models, including scholarships, financial aid programs, and e-learning options that provide more affordable ways for students to access veterinary education.

In addition, the growth of private veterinary schools such as the Midwestern University College of Veterinary Medicine, which offer competitive tuition pricing, has added an alternative to traditional public veterinary schools, further driving the competition and shaping the tuition landscape within the market.

The market is highly competitive, with several key players contributing to its dynamics. Given the presence of both small and large companies, the market remains somewhat fragmented, creating significant competition, particularly for smaller players trying to secure their position. To strengthen their market presence, companies are increasingly utilizing strategies such as mergers and acquisitions, geographic expansion, and introducing new study programs to foster growth and gain a competitive edge.

In May 2024, Evette and Shepherd Veterinary Software established a collaborative partnership aimed at addressing the shortage. The partnership involved multiple stakeholders from the educational sectors and used its practice information management system (PIMS) in the U.S. The partnership focused on creating initiatives to increase the number of animal health professionals and improve their distribution, particularly in underserved areas. This included enhancing educational programs and providing better support for students and graduates.

In March 2024, the World Veterinary Association and Brooke collaborated to develop the world’s first Essential Veterinary Medicines List (EVML) for food-producing animals, a groundbreaking initiative promoting animal health and welfare worldwide. By ensuring the global availability of critical animal medicines, the EVML provides a valuable resource for policymakers and veterinarians, enabling them to deliver high-quality animal care to the agricultural sector and ultimately improve the lives of millions of animals

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 808.6 million

|

|

Revenue forecast in 2030

|

USD 1,167.3 million

|

|

Growth rate

|

CAGR of 7.62% from 2025 to 2030

|

|

Actual data

|

2018 – 2024

|

|

Forecast period

|

2025 – 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Course, specialty, institution, delivery mode, duration, end customer, and type

|

|

Key providers profiled

|

University of California – Davis; Cornell University; Auburn University; Tuskegee University; University of Arizona; Midwestern University; University of Florida; University of Georgia; University of Illinois; Purdue University

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the veterinary education market report based on course, specialty, institution, delivery mode, duration, end customer, and type:

Course Outlook (Revenue, USD Million; 2018 – 2030)

Graduate Courses

Post-graduate Courses

Standalone Courses

Specialty Outlook (Revenue, USD Million; 2018 – 2030)

Veterinary Surgery

Veterinary Medicine

Veterinary Nursing

Animal Grooming

Other Specialties

Institution Outlook (Revenue, USD Million; 2018 – 2030)

Delivery Mode Outlook (Revenue, USD Million; 2018 – 2030)

Classroom based Courses

E-Learning

Duration Outlook (Revenue, USD Million; 2018 – 2030)

Less the 1 year

1 – 2 years

More than 2 years

End Customer Outlook (Revenue, USD Million; 2018 – 2030)

New Students

Veterinarians

Type Outlook (Revenue, USD Million; 2018 – 2030)

b. The U.S. veterinary education market size was estimated at USD 754.4 million in 2024 and is expected to reach USD 808.6 million in 2025.

b. The U.S. veterinary education market is expected to grow at a compound annual growth rate of 7.62% from 2025 to 2030 to reach USD 1,167.3 million by 2030.

b. Graduate courses dominated the U.S. veterinary education market with a share of over 39% in 2024. This is attributable to the increasing demand for advanced and specialized training.

b. Some key players operating in the U.S. veterinary education market include University of California – Davis, Cornell University, Auburn University, Tuskegee University, University of Arizona, Midwestern University, University of Florida, University of Georgia, University of Illinois, Purdue University

b. Key factors that are driving the market growth include rising demand for specialized services, alongside increasing government initiatives aimed at strengthening veterinary education.

Leave a comment